Stamp duty, also referred to as transfer duty, is a tax which must be paid on certain purchases in Australia. Whilst the concept may seem simple, transfer duty can quickly become a headache for many Australians.

Depending on the state you make your purchase, the rules, rates and concession you may be eligible for differ greatly. Of course, for the most accurate and personalised advice speak to your local broker.

Stamp duty can be an expensive and often unavoidable cost for many. So, here are the basics you need to know about transfer duty before making a big purchase.

What is stamp duty?

According to the Australian Government, stamp duty refers to the tax charged by State or Territory Governments for certain documents and transactions. Whilst the term is mostly associated with purchasing a home, there are many other things Australians are required to pay stamp duty on when transferring ownership.

What do you have to pay stamp duty on in Australia?

In Australia, there are five main things Australians are required to pay stamp duty on, including:

- Motor vehicle registration and transfer.

- Insurance policies.

- Leases and mortgages.

- Hire purchase agreements.

- Transfers of property, whether this be land, realestate, some shares or a business.

How is stamp duty calculated?

Depending on the state or territory you’re purchasing in, the cost of stamp duty will vary.

Calculating stamp duty in Victoria.

According to infochoice.com.au, in Victoria, stamp duty for property sales is calculated using a sliding scale. Meaning, the amount of stamp duty you pay is determined by purchase price.

For example, purchases valued at $25,000 or less incur a 1.4% stamp duty tax. On the other end of the scale, properties valued over $960,001 incur a rate of 5.5%.

Calculating stamp duty in Queensland.

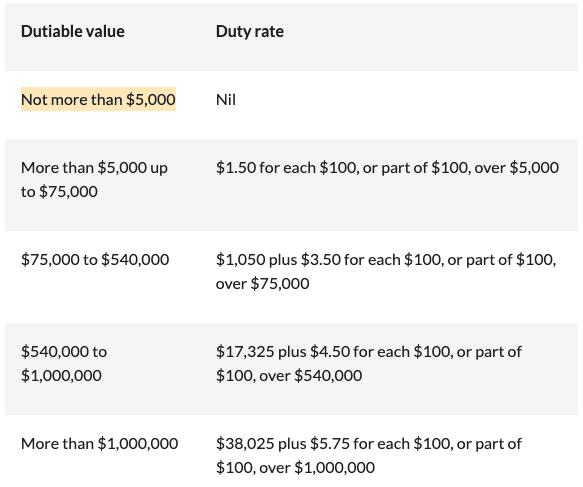

In Queensland, transfer duty is calculated using a method similar to the income tax brackets.

An example provided by the Queensland Government outlines the transfer duty payable on a $365,400 home. Firstly, it can be seen the home falls within the $75,000 to $540,000 bracket, meaning the rate is determined the following way:

STAMP DUTY = $1,050 (for the initial $75,000)

$10,164 ([$365,000 – $75,000] /100 x 3.50)

$10,164 + 1,050

= $11,214

It’s important to note your personal circumstances, such as being a first time home buyer may alter the rate of stamp duty required to be paid. Check with your local accountant to get the most accurate information for your personal situation.

https://www.instagram.com/p/B0XKNPXAfs3/

Calculating stamp duty in New South Wales.

Transfer duty, or stamp duty, is calculated in NSW using a sliding scale method, according to realestate.com.au. Naturally, the higher the purchase price of the item you’re required to pay stamp duty on, the greater the stamp duty payable.

For example, property purchased between $300,001 and $1,000,000 will incur a stamp duty of $8,990 plus 4.5% for every dollar over $300,000 in NSW.

Similar to other states and territories, the amount of stamp duty required to be paid in NSW differs depending on your situation. For example foreign and first home buyers will pay different rates.

Calculating stamp duty in the Northern Territory.

Stamp duty is calculated in the Northern Territory using a complex formula accompanied with a sliding scale system. According to realestate.com.au, properties up to the value of $525,000 are calculated using the below formula:

Stamp Duty = (0.06571441 x V) + 15V, where V is 1/1,000 of the property’s dutiable value.

For properties with a value higher than this, it is simply a percentage of the purchase price. This is determined by pricing brackets with the highest being 5.95% on those worth more than 5 million.

https://www.instagram.com/p/BQKWxgBg_Mr/

Frequently Asked Questions About Stamp Duty

How much is stamp duty?

The amount of stamp duty required to be paid on a particular purchase depends on the State or Territory Government the purchase is being made in. Stamp duty is determined by State and Territory Governments, so rates vary.

Are there any stamp duty exemptions?

Obtaining a stamp duty exemption is difficult. In some states and territories, an exemption can be given when the property transfer is between spouses, there is a change in tenure or when purchasing a mobile home.

What are stamp duty concessions?

Stamp duty concessions are discounts on stamp duty rates potentially available to people in certain situations. The concessions available depend on the state in which you’re purchasing. For example, whilst QLD and NSW both have first home buyer concessions, the benefits it includes differ.

What stamp duty concessions are available in QLD?

In Queensland, the following concessions are available on stamp duty:

- First home concession.

- Home concession.

- First home — vacant land concession.

- Vacant land.

- Investment property concession.

Speak to your local broker to find out more about stamp duty tax in your area.

The information contained in this blog is true at the time of publishing. Information in this blog for general informational purposes only and should not replace professional advice.